Product details

| Data as of: | 31.01.2024 |

| Minimum Investment: | $100,000 |

| Liquidity | instant via API |

| Management Fees | 2% annually |

| Performance Fees | 20% with HWM (* Calculated on the outperformance over Bitcoin) |

| Structure | Separately Managed Accounts (SMAs) – DDA Alpha AG |

Performance Data (Back-tested)*

| Strategy Returns / Risk Indicators | Time | Strategy | Bitcoin |

| Cumulative Returns | YTD | -5.43% | 0.70% |

| 3M | 27.13% | 22.92% | |

| 6M | 49.68% | 45.66% | |

| BTD | 4,831.64% | 1,050.39% | |

| Annualized Returns | 1Y | 69.20% | 84.12% |

| BTD | 115.30% | 61.69% | |

| Annualized Volatility | 1Y | 42.91% | 44.72% |

| BTD | 64.91% | 67.70% | |

| Tracking Error | 1Y | 13.87% | |

| BTD | 16.42% | ||

| Information Ratio | 1Y | -1.10 | |

| BTD | 3.24 | ||

| Outperforming Months | 1Y | 50.00% | |

| BTD | 60.00% |

General Information

Summary

- Enhancing returns vs. traditional indices

- Diversification across a large crypto universe

- Reducing risk vs. the underlying market

- Strategy benchmarked over Bitcoin

Investment Objective

The DDA Smart Beta Diversified Strategy is benchmarked over Bitcoin and designed to provide a global market exposure with improved diversification across a rather large universe of crypto assets. The investment objective is to enhance returns by capturing consistent Alpha over the underlying core market, while reducing overall risk compared to traditional capitalization-weighted indices. The portfolio is built using several smart beta indices, each of them following distinct alpha-seeking methodologies across trend following models, momentum indicators and thematics’ allocation. The volatility of the portfolio’s returns relative to its benchmark will be monitored as a tracking error and recalibrated over time.

Investment Strategy

The strategy is an actively managed allocation across four proprietary smart beta indices, rebalanced weekly using alternative data and market sentiment tools, and bringing overall decorrelation vs the underlying core market.

- Bitcoin RV Tilt : A long BTC exposure tilted with several RV trend following models implemented across core and liquid trading pairs.

- All Stars 1/n : Long Only models implemented across a curated universe of n rising coins for 1/n % each and allocating to the coin in case of positive trends, or to Bitcoin otherwise.

- Top 50 Momentum : The index is designed to pick coins with strongest uptrends based on momentum indicators, with a weekly turnover smoothed over daily rebalancing mechanisms

- Global Thematics : The index enables exposure across 10 distinct thematics (Store of Value, Smart Contracts, Privacy, NFTs, Web 3.0, Interoperability, CEXs, DeFi, Memes and Stable Coins) based on sentiment scoring with daily rebalancing.

Calendar Performance Data (Back-tested)*

| Calendar | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| Jan | -6.29% | 30.79% | 35.85% | -16.42% | 40.41% | -5.43% |

| Feb | 14.39% | -3.29% | 78.75% | 5.41% | -2.29% | |

| Mar | 12.71% | -19.67% | 44.00% | 8.32% | 16.83% | |

| Apr | 22.93% | 32.82% | 24.04% | -19.14% | -0.26% | |

| May | 60.66% | 12.19% | -23.46% | -13.78% | -7.45% | |

| Jun | 25.14% | -0.83% | -7.45% | -33.47% | 11.44% | |

| Jul | -7.80% | 26.99% | 16.59% | 19.49% | -3.74% | |

| Aug | -8.04% | 12.64% | 29.95% | -14.07% | -11.42% | |

| Sep | -13.56% | -7.40% | -0.70% | -2.47% | 5.41% | |

| Oct | 7.64% | 23.52% | 38.48% | 5.82% | 26.10% | |

| Nov | -13.85% | 41.77% | 3.39% | -15.33% | 14.08% | |

| Dec | -3.43% | 41.73% | -15.64% | -5.74% | 17.83% | |

| Year | 95.97% | 393.61% | 458.33% | -62.56% | 151.21% | -5.43% |

* Live Performance Results: The strategy was launched at DDA on 1st August 2022 with real AUM and has been trading live ever since on proprietary trading accounts and across the same trading venues used for our investors under separately managed accounts (SMAs). The performance figures shown are net of global execution costs based on our trading accounts’ investment results and are calculated net of 2% annual management fees (paid quarterly) and 20% performance fees (benchmarked over Bitcoin and paid annually with HHM). These investment results are not audited nor verified by a third-party administrator.

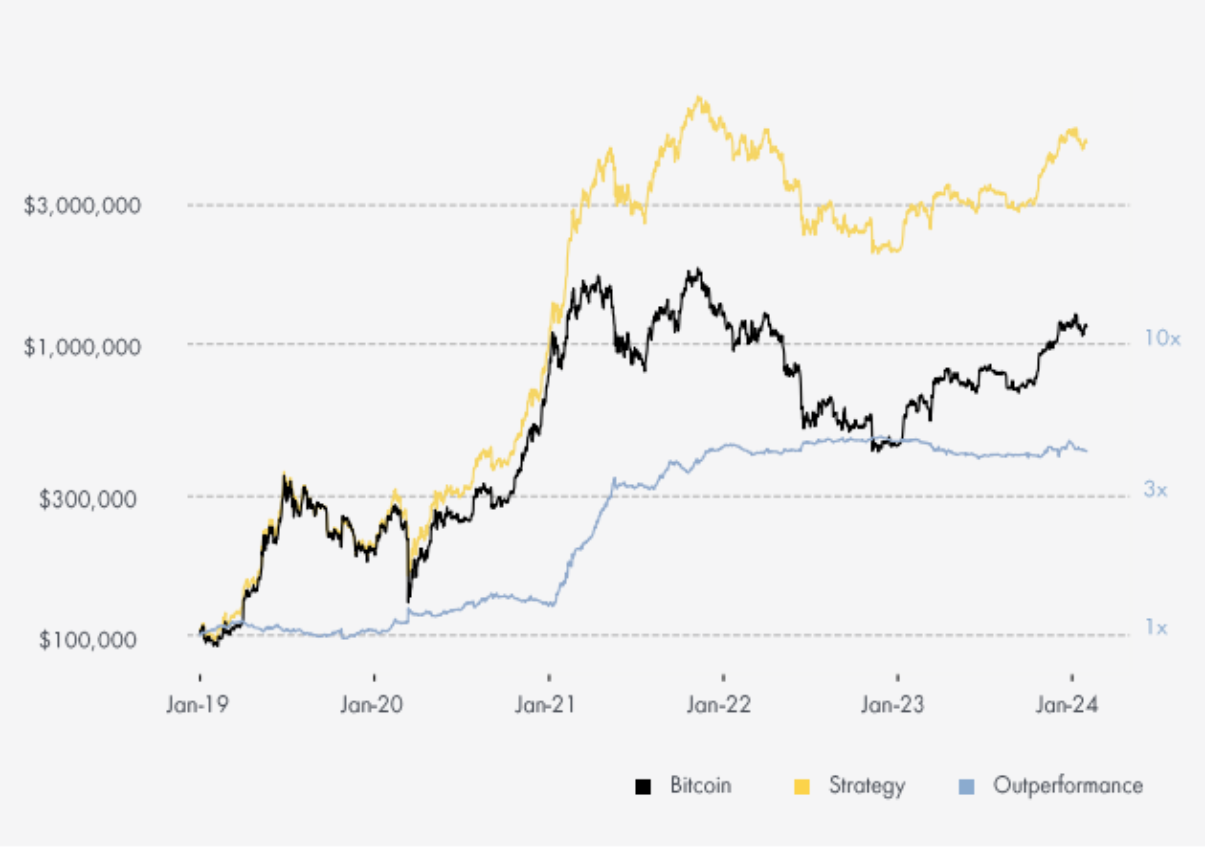

DDA Smart Beta Diversified Strategy Performance vs. Bitcoin

The adjacent chart shows the investment performance of the minimum subscription amount of $100,000 into the strategy on a logarithmic scale. The returns presented herein for the period 1st January 2019 through 31st July 2022 represent back-tested performance and do not reflect trading in actual accounts. The strategy was launched at DDA on 1st August 2022 with real AUM and has been trading live ever since on proprietary trading accounts. The performance track shown uses daily points, calculated at 0h00 UTC net of all fees and global trading costs based on our trading accounts’ investment results. Please refer to the previous page for more details.

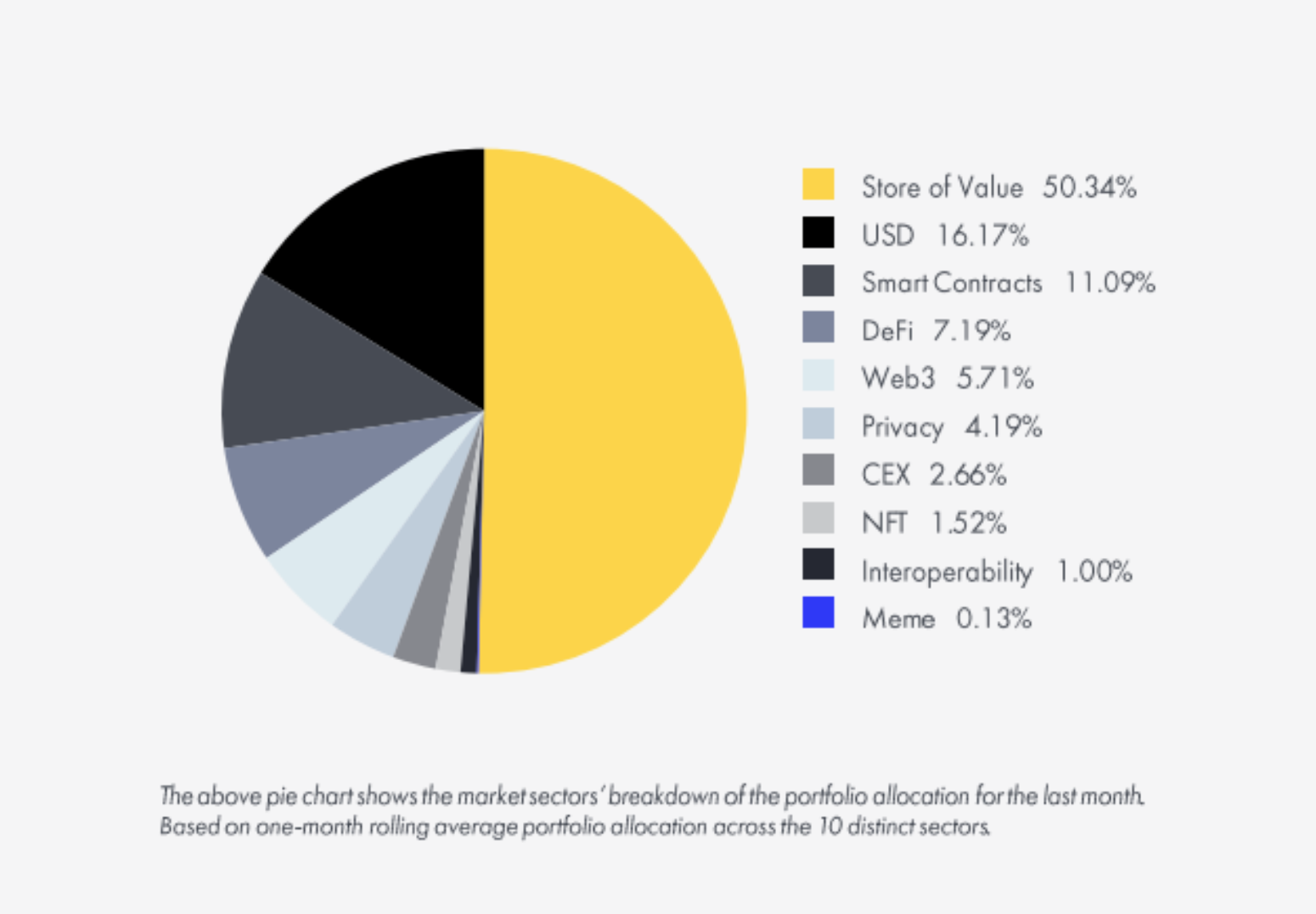

DDA Smart Beta Diversified Strategy Market Sectors’ Breakdown

The adjacent pie chart represents the portfolio allocation across 10 distinct thematics for the last month. The allocation is actively managed and based on market sentiment data and proprietary scoring models, with a weekly rebalancing.

Store of Value: Coins considered as normally retaining purchasing power over time

USD: Stable Coins

Smart Contracts: Enabling programs to run when predetermined conditions are met

DeFi: Decentralized Finance

Web3: New iteration of the Web which incorporates blockchain technologies

Privacy: Coins that are designed with privacy protection in mind

CEX: Centralized Exchanges

NFT: A non-fungible token (NFT) is a unique digital identifier that cannot be copied

Interoperability: Empowering many blockchains to communicate and share data

Meme: Speculative coins supported by enthusiastic online trading communities

Metrics Comparison Dashboard

Crypto Market Risks

The crypto markets are extremely volatile and subject to additional investment risks relative to traditional investments including, but not limited to inherent technological risks in the blockchain, severe and sudden volatility and market manipulation. The strategy is designed as a long- term investment and investing in the strategy involves the risk that you may receive little or no return from your investment or that you may lose part of even all your investment. The strategy seeks to provide steady returns over time while reducing risks, therefore the strategy’s performance may over-or underperform the overall crypto asset market.